GoodLife - Highlights

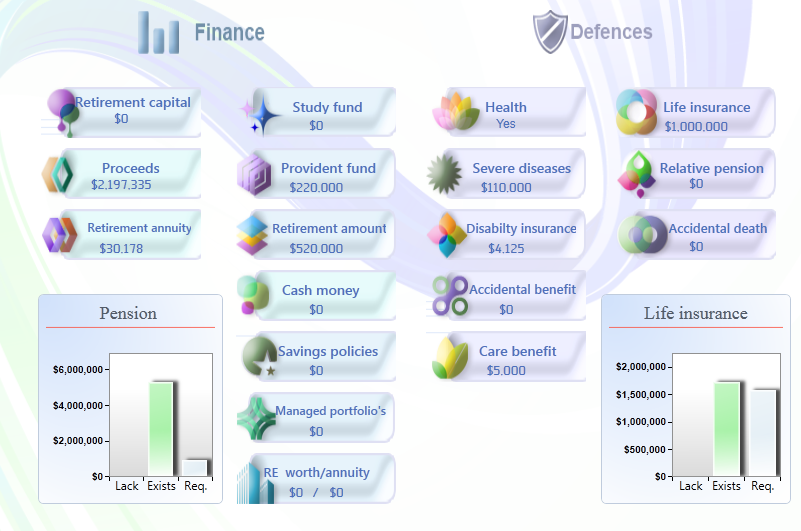

1. Holistic Planning

The G-Life system enables to perform holistic plans for the client. The system discerns between four types of financial tools available to the client:

- Protection in case of death - funds that are availble to the insured's beneficiaries.

- Protection for family needs - funds and insurance availble to the insured and to his family in times of need.

- Available fund - what are the accumulated sums in the various plans today.

- Retirement age - what annuity and cash value shall be available to the client upon retirement.

The System enables convenient completion of gaps which exist in the various issues.

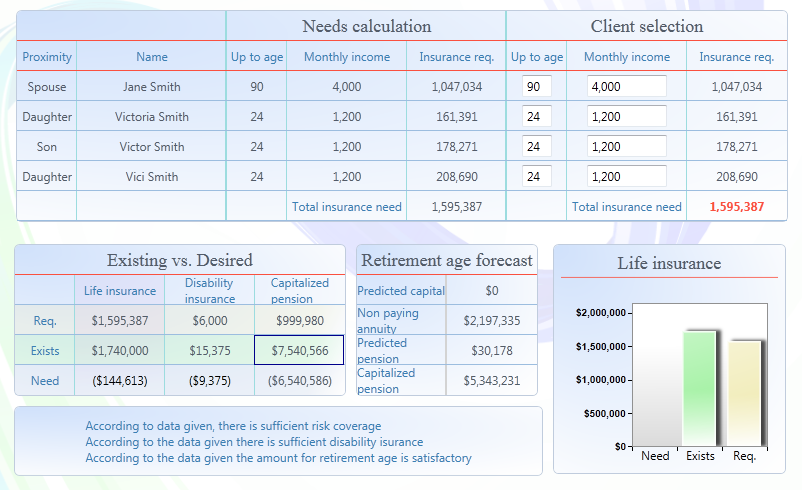

2. Pension and Financial Plan

The G-Life system automatically suggests a pension plan for the client. The system performs a calculation of primary needs based on a set of parameters. The parameters can be customized by the broker.

The system shares information with the insured and enables him to choose sums required to the family and to himself: "the choice of the insured".

Based on the choices performed by the insured, the system defines the existing gaps.

Using the personal choice, the insured sets the insurance sums, and this process substantially weakens the natural resistance of certain individuals to purchase new insurance products. Bridging the gaps, the purchase of new insurance products, is done automatically by the system.

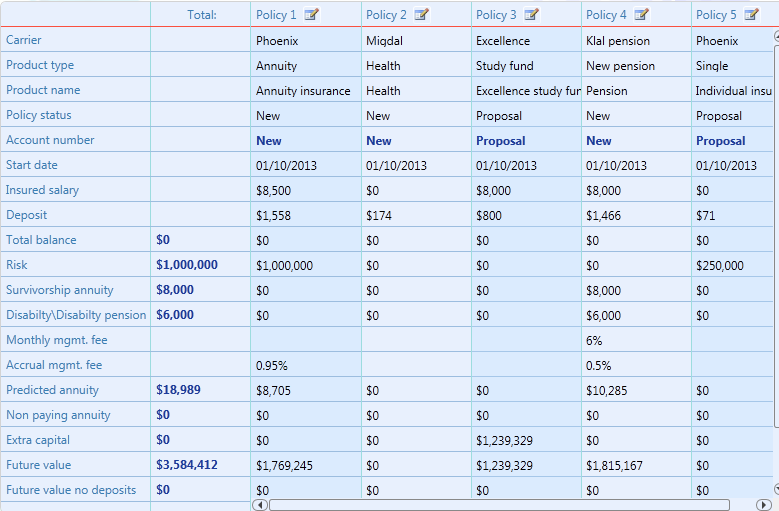

3. Displaying an Existing/Updated portfolio

The G-Life system conveniently displays to the client all his plans, of all the carriers, that exist in his portfolio, as well as all his financial and real-estate assets.

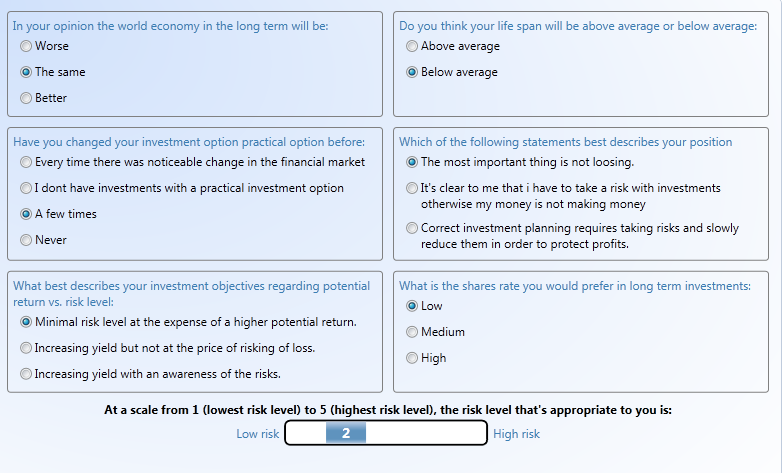

4. Risk Questionnaire

The G-Life system defines the desired risk level, implementing the regulation in a user-friendly way, sharing the process with the client.

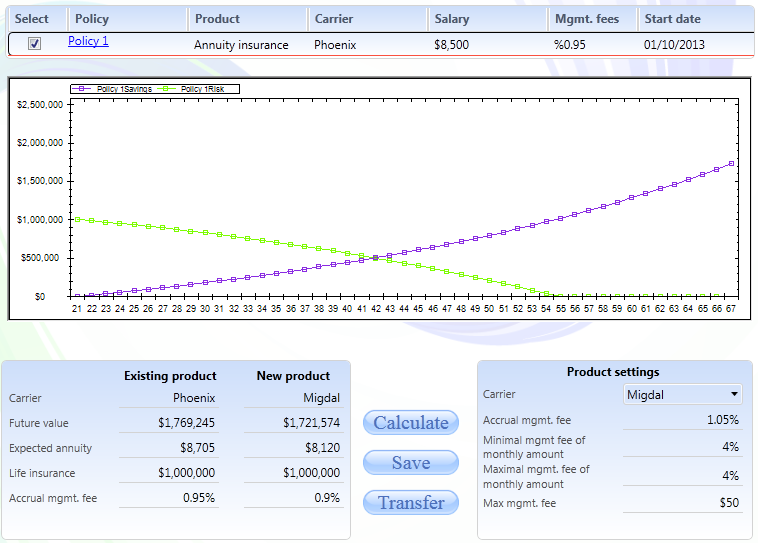

5. Smart Graph

The smart graph is a unique tool in 2Team, and the G-Life software. It enables an examination of the appropriate alternatives to the existing plan, in a graphic, intuitive way.

The existing plan is displayed in a graphic manner: the broker can choose to examine a better plan and determine the objective of the check.

One objective: increasing the sum saved or the annuity, while maintaining the existing risk of the original plan.

Another objective: Increasing the risk while maintaining the existing savings / annuity.

The operation of the smart graph is done by dragging a line. The response time is immediate.